Sobre nós

Investimento responsável

É fundamental investir de forma responsável. Por este motivo, procuramos integrar considerações Ambientais, Sociais e de Governação (ESG) na nossa abordagem fundamental ao research e à gestão de investimentos.

Acreditamos que é parte integrante da criação de riqueza a longo prazo – impulsionada por um intenso research, propriedade ativa e aprendizagem contínua.

O research de investimento responsável é disponibilizado a todos os gestores de carteiras. Algumas equipas podem atribuir mais, menos ou nenhuma ênfase aos fatores ESG numa determinada decisão de investimento.

Capacidades poderosas

Propriedade ativa

Soluções de produtos

Moldar o mercado

45+

ESPECIALISTAS EM ESG

Os nossos especialistas em investimento responsável apoiam os nossos clientes, profissionais de investimento e interesses empresariais mais alargados através de research, envolvimento, votação, dados, relatórios, desenvolvimento de produtos e avaliação de carteiras especializadas em ESG, orientados para as questões ESG.

250+

ANALISTAS DE RESEARCH

Os gestores de carteiras, os analistas de research e os analistas ESG constituem um elo fundamental para a equipa de investimento responsável e realizam research e envolvimento específicos por classe de ativos. Tal permite-nos integrar financeiramente questões ESG relevantes no nosso processo de tomada de decisões.

40 Yrs

DE EXPERIÊNCIA EM INVESTIMENTO RESPONSÁVEL

Desde há mais de quatro décadas, e através das empresas que nos antecederam, temos estado na vanguarda do investimento responsável. O nosso património em matéria de investimento responsável remonta ao primeiro fundo social e ambiental da Europa, há mais de 35 anos. Começámos a empenhar-nos nas alterações climáticas através do nosso serviço reo®, em 2000, e fomos um dos membros fundadores dos Princípios para o Investimento Responsável das Nações Unidas, em 2006.

Um centro de excelência a nível mundial

Dispomos internamente de uma profusão de conhecimentos ESG especializados, liderada pela nossa equipa de especialistas dedicados em investimento responsável.

Uma combinação poderosa que nos permite aproveitar as melhores ideias de toda a nossa plataforma de investimento para satisfazer as necessidades dos nossos clientes.

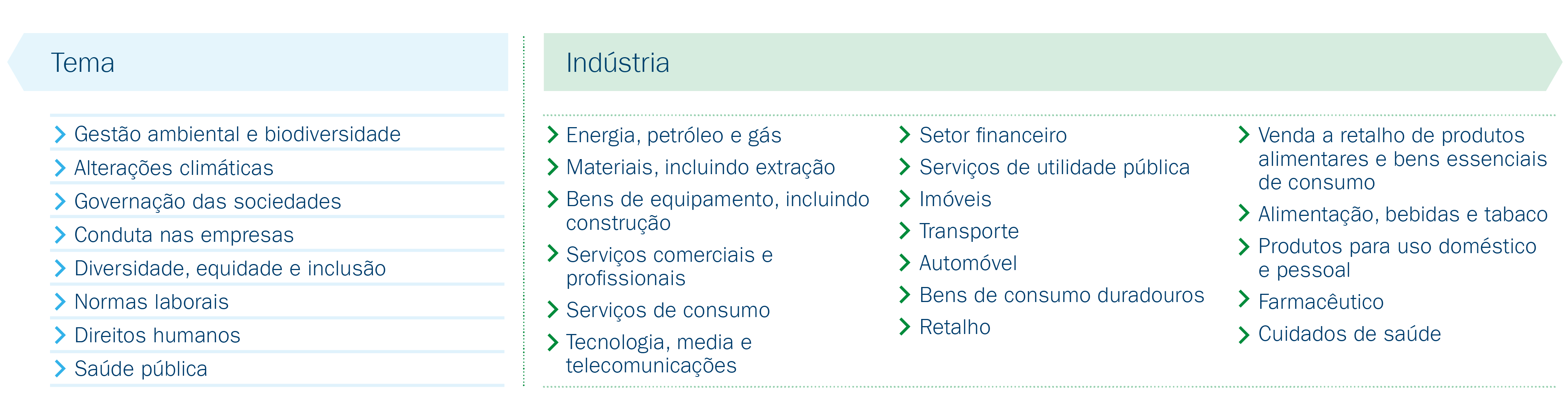

Amplitude setorial e da indústria

Os nossos especialistas de investimento responsável possuem uma ampla gama de conhecimentos setoriais e temáticos que nos ajudam a desenvolver e apoiar uma vasta gama de oportunidades de investimento.

Ferramentas e quadros de research

Dispomos de uma vasta gama de poderosas ferramentas e quadros de research que estão no centro do nosso motor de investimento responsável. Estes informam a integração das questões ESG no research de investimento, na construção de carteiras e na monitorização do risco.

A medida de utilização destas ferramentas varia em função do mandato e dos objetivos estratégicos do cliente.

Alavancar o envolvimento proativo e a votação por procuração para maximizar o valor para o investidor

A nossa extensa equipa de propriedade ativa representa um vasto leque de experiência e conhecimentos especializados em indústrias, setores e temas de investimento responsável. Em estreita colaboração com analistas de research e gestores de carteiras, investigam questões fundamentais e envolvem os decisores a vários níveis das suas organizações, para compreender como são geridos os fatores, riscos e oportunidades ESG.

Centrado em reforçar a confiança

A nossa principal abordagem ao envolvimento é a utilização de um diálogo construtivo e confidencial, interagindo normalmente por nossa conta com os principais decisores. Como investidores a longo prazo, valorizamos as relações baseadas na confiança.

Também colaboramos com outros investidores, organizações não governamentais (ONG) ou grupos setoriais, sempre que tal seja considerado como sendo do interesse económico a longo prazo dos nossos clientes.

Criar uma mudança positiva através da votação por procuração

Utilizamos o voto por procuração para promover o progresso e a melhoria dos emitentes em relação aos principais temas ESG e para estimular a boa governação das sociedades e práticas de mitigação de riscos. Consideramos que se trata de uma ferramenta eficaz para representar os interesses dos nossos clientes e garantir que os emitentes não só escutam as nossas preocupações e preferências, como também atuam de forma adequada.

Rumar em direção a resultados eficazes

Definimos objetivos de envolvimento claros e acionáveis para nos ajudar a demonstrar o valor para o investidor.

A nossa propriedade ativa engloba um amplo espetro de riscos e oportunidades ESG, abrangendo emitentes de todos os setores e áreas geográficas.

Estruturamos o nosso envolvimento em torno de sete temas de alto nível alinhados com os 17 Objetivos de Desenvolvimento Sustentável das Nações Unidas e com as metas subjacentes.

Estratégias para o investimento responsável

Indivíduos, instituições e empresas de todo o mundo contam connosco para gerir o seu dinheiro de uma forma que, simultaneamente, sirva os seus objetivos financeiros e esteja de acordo com os seus valores. Mas, naturalmente, a estratégia de investimento responsável ideal é diferente para cada um.

Durante mais de 40 anos, provámos a nossa capacidade de inovar e de oferecer uma vasta gama de estratégias de investimento responsável para servir os nossos clientes:

Oferecemos uma ampla gama de fundos ESG comuns entre todas as principais classes de ativos, incluindo múltiplos ativos e alternativos. Independentemente do seu foco ou mandato de investimento responsável, podemos criar uma solução que se adapte às suas preferências únicas.

(reo®) – O nosso serviço Responsible Engagement Overlay

Fomos pioneiros na propriedade ativa com a criação do nosso serviço Responsible Engagement Overlay (reo®) em 2000, através do qual os clientes nos confiam o envolvimento e o voto em seu nome. reo® oferece aos clientes acesso ao pacote completo de conhecimentos especializados de stewardship, incluindo:

Relatórios alinhados com os ODS que especificam o impacto do nosso envolvimento

Cobertura global intersetorial em todo o espetro de capitalização bolsista

20+ especialistas em propriedade ativa

Historial de 23 anos de envolvimento

Tenha em atenção que o serviço reo® poderá estar indisponível em algumas jurisdições.

Abraçar a gestão e a responsabilidade globais

Como grande gestor de ativos a nível mundial, levamos a sério a nossa responsabilidade de ajudar a promover o bom funcionamento do sistema financeiro. A longo prazo, tal beneficia os nossos clientes e a sociedade em geral. Empenhamo-nos em ser um empregador responsável e em prestar uma contribuição ativa para as comunidades em que operamos. Ser responsável é fundamental para a nossa cultura.

Parte de um grande diálogo

Desempenhamos um papel ponderado e proativo no desenvolvimento de políticas públicas através do envolvimento com governos e reguladores em questões fundamentais, empenhando-nos em estabelecer normas enquanto voz construtiva dos investidores. Colaboramos com outros investidores através de vários grupos de trabalho do setor para compreender melhor as questões ESG emergentes, bem como para partilhar os nossos conhecimentos com o setor em geral.

Atuar com propósito

Somos signatários de longa data de normas e códigos de investimento responsável estabelecidos, e estamos empenhados em melhorar a diversidade, a equidade e a inclusão na nossa atividade. Consideramos também cuidadosamente o impacto climático da nossa atividade e envolvemo-nos em iniciativas filantrópicas através dos nossos donativos e apoio a instituições de caridade. Os nossos compromissos empresariais incluem:

Signatários dos Códigos de Gestão do Reino Unido, de Taiwan, do Japão e da Coreia

Signatários fundadores dos Princípios para o Investimento Responsável das Nações Unidas

- Signatários da Net Zero Asset Managers Initiative

- Membro da Climate Action 100+

- Membro da Investor Alliance, em apoio ao respeito pelos direitos humanos

- Signatários do Investor Stewardship Group norte-americano, que consiste num grupo de investidores e gestores de ativos que promove boas práticas em matéria de gestão e de governação das sociedades

- Signatários fundadores do UK Women in Finance Charter

Policies

Disclosures

A

Adverse impact

Aggregate sustainability risk exposure

The overall sustainability risk faced by a company or portfolio, taking account of a range of issues such as climate risk and ESG factors.

B

Best-in-class

Best-in-class strategies try to make their portfolios better on ESG issues and/or carbon characteristics by excluding certain investments deemed negative in that respect or including certain investments deemed positive in that respect.

C

Carbon footprint

The carbon emissions and carbon intensity of a portfolio, compared with its investment universe (benchmark). The benchmark might be, for example, companies in the FTSE 100.

Carbon intensity

A company’s carbon emissions, relative to the size of the business. This allows investors to compare the company’s carbon efficiency with its competitors’.

Climate risk

The risk that an investment’s value could be harmed by climate issues such as global warming, energy transition and climate regulation. Investors normally assess climate risk by looking at carbon footprint data, climate adaptation risk, physical risk and stranded assets.

Climate adaptation risk

See Transition Risk.

Controversies

A company’s operational failures or everyday practices that have severe consequences for workers, customers, shareholders, wider society and the environment. Examples are poor employee relations, human rights abuses, failure to follow regulations, and pollution. Controversies help to indicate the quality of a company.

Corporate governance

The way that companies are organised and led. We look at how well companies are sticking to good practices set out in Corporate Governance Codes, which vary from country to country. Corporate governance is also part of the ‘G’ in ESG. In this context Governance may focus on the operational and management practices relating to social and environment aspects of the business.

Corporate Social Responsibility (CSR)

A company’s approach to (and engagement with) its stakeholders and the communities it operates in, reflecting its responsibility towards people and planet.

D

Decarbonisation

The reduction of the carbon emissions associated with a region, country, industry or organisation. It can also refer to the reduction of the carbon emissions associated with a fund’s investments.

Divestment

The opposite of investment. In other words, either reducing or exiting an investment. We divest if we think the potential risks of investing in a company outweigh the potential returns. This may be because we have lost confidence in a company’s leadership, strategy, practices or prospects .

E

Engagement

Talking to members of the board or management of a company – a two-way process that we might initiate, or the company might initiate. We use engagement to understand companies better. We also use it to give feedback, offer advice and seek changes – including change relating to ESG and climate risk. Engagement also means consulting with government and collaborating with other investors to influence policy and shape debate.

Environmental

The “E” in ESG. This covers a focus on significant environmental risks and their management. In a climate change context it is a focus on the risks associated with a business having to adapt to climate change requirements or the physical impacts of climate change. We also look at companies’ environmental opportunities due to changing consumer demands, policy changes, technology and innovation.

ESG

Short for environmental, social and governance. Investors consider companies’ ESG risks and how well they are managed. To do this, we use the Sustainability Accounting Standards Board (SASB) framework. Considering ESG gives us a different perspective on how good an investment might be.

ESG integration

Always taking account of ESG issues when assessing potential investment opportunities and monitoring the investments in a portfolio.

ESG ratings

Many investment managers use external providers, such as MSCI, to rate companies on their ESG practices. Each provider has its own way of doing things, so ESG scores can vary radically from one provider to another. We run our own ESG system to rate companies. This is based on 77 standards, each for a different industry, produced by the Sustainability Accounting Standards Board.

Ethical investing

An ethical approach excludes investments that conflict with the client values and ethics that a fund is seeking to reflect. There are many different activities or issues that people prioritise as ethical. Common examples include tobacco, adult entertainment, controversial weapons, coal or activities that contravene religious social teaching.

Exclusion

Excluding companies from a portfolio. Exclusions can also be used to set minimum standards or characteristics for inclusion of investments in portfolios. Fund managers may exclude entire industries (e.g. tobacco), companies involved in ethically questionable activities (e.g. gambling), companies that fail to meet certain ESG standards, and companies with a bad carbon intensity.

F

Fundamental analysis/research

Using research to work out the true value of an investment, rather than its current price. Many factors contribute to this, including responsible investment factors. Responsible investment helps us understand the quality of a company, its scope to develop and improve (e.g. in response to climate transition) and its prospects (through making money from responding to sustainability issues). Even if a company is good, it is unlikely to offer good investment returns if this is already reflected in the share price.

G

Green bonds

Debt issued by companies or governments, with the money raised earmarked for green initiatives such as building renewable energy facilities.

Greenwashing

Insincere approaches to climate change and other ESG issues by companies, including investment management firms. For example, an investment manager may label a fund as an ESG fund, even if it does not adopt ESG integration in practice.

I

Impact investing

International Labour Organisation (ILO)

A United Nations agency, often abbreviated to “ILO”, that sets international standards for fairness and safety at work. The ILO standards are commonly used by investors to assess how serious a corporate controversy is.

M

Materiality

An ESG issue is “material” if it is likely to have a significant positive or negative effect on a company’s value or performance.

N

Norms-based screening

Screening investments for potential controversies by looking at whether a company follows recognised international standards. We consider standards including the International Labour Organisation standards, the UN Guiding Principles for Business and Human Rights and the UN Global Compact. Specialist RI funds may exclude companies that do not meet these standards.

P

Physical risk

The physical risks of climate change for businesses, such as rising sea levels, water shortages and changing weather patterns.

Portfolio tilts

Investment industry jargon for having more of something in a portfolio than the benchmark, or less of it. In responsible investment it usually means having more companies in a portfolio that have better ESG credentials or are less exposed to climate risk than there is in the benchmark. The tilt is measured as the overall exposure to a specific type of investment in a portfolio compared to that in the benchmark.

Positive inclusion/screening

Seeking companies that have good ESG practices or that help the world economy be more sustainable. Also used as an alternative to “best-in-class“. The opposite of exclusion.

Principles for Responsible Investment

Often shortened to PRI. A voluntary set of six ethical principles that many investment companies have agreed to adopt. Principle 1, for example, is: “We will incorporate ESG issues into investment analysis and decision-making processes.” The PRI was sponsored by the United Nations. Columbia Threadneedle is a founding signatory, and has attained the top A+ headline rating for its overall approach for the sixth year running.

Proxy voting

Voting on behalf of our clients at company general meetings to show support of their practices and approach – or to show our dissent. We put our voting record on our website within seven days of the vote.

R

Responsible Investment (RI)

The umbrella term for our approach towards managing our clients’ money responsibly. This includes the integration of ESG factors, controversies, sustainability opportunities and climate risks into our investment research and engagements with companies, to inform our investment decisions and proxy voting.

Responsible Investment Ratings

Mathematical models created by our responsible investment analysts that provide an evidence-based and forward-looking indication of the quality of a business and its management of risk.

S

SDR (Sustainability Disclosure Requirements)

The Sustainability Disclosure Requirements (SDR) and labelling regime is a UK framework introduced by the Financial Conduct Authority (FCA) to improve transparency and consistency in how investment products and firms disclose sustainability-related information. It is part of the UK’s broader efforts to combat greenwashing (misleading sustainability claims about a product or service) and promote the transition to a greener economy. The SDR regime includes a robust anti-greenwashing rule, sustainability investment labels (to help investors find products that have a specific sustainability goal), as well as comprehensive disclosure rules and naming and marketing rules for retail funds.

SDR - Consumer-facing Disclosure (CFD)

The CFD is an important component of the FCA’s Sustainability Disclosure Requirements (SDR). It is a two-page document designed to help retail investors make informed decisions by providing a clear and concise overview of the sustainable features of funds that use a sustainability label, as well as funds that might not meet the criteria for a label, but nevertheless have certain sustainability-related characteristics.

SDR - Sustainability Focus

The Sustainability Focus Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in assets that focus on sustainability for people or the planet.

SDR - Sustainability Impact

The Sustainability Impact Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in solutions to sustainability problems, with an aim to achieve a positive impact for people or the planet.

SDR - Sustainability Improvers

The Sustainability Improvers Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that may not invest in assets that are sustainable now, but which aim to improve their sustainability for people or the planet over time.

SDR - Sustainability Mixed Goals

The Sustainability Mixed Goals Investment Label is one of four labels introduced under the Sustainability Disclosure Requirements (SDR) and labelling regime. This label is intended to indicate, and help investors find, products that invest mainly in a mix of assets that either focus on sustainability, aim to improve their sustainability over time, or aim to achieve a positive impact for people or the planet.

Scope 1, 2 and 3 emissions

The building blocks used to measure the carbon emissions and carbon intensity of a company. Under an international framework called the Greenhouse Gas Protocol these are divided into Scope 1, 2 and 3 emissions. Scope 1 emissions are generated directly by the business (e.g. its facilities and vehicles). Scope 2 covers emissions caused by something a company uses (e.g. electricity). Scope 3 is the least reliable because it is the hardest to measure. It covers other indirect emissions generated by the products it produces (e.g. from people driving the cars a company makes).

Screened funds

Funds that use screens to exclude companies that do not meet their ethical criteria, ESG expectations, carbon intensity or controversy standards.

Social

The “S” in ESG. Investors analyse social risks and how these are managed. This includes a company’s treatment of its employees and its human rights record for other people outside the company (e.g. in the supply chain). It also refers to a company’s commercial opportunities in responding to changing consumer demands, policy changes or technology and innovation (e.g housing, education or healthcare).

Social bonds

Bonds issued to raise money for a socially useful purpose, such as education or affordable housing. Social bonds follow the standards set by the International Capital Market Association (ICMA) and appoint independent external reviewers to confirm the money raised will be used appropriately.

Socially Responsible Investing (SRI)

A form of ethical investment that attaches particular importance to avoiding harm to people or the planet, from the investments being made.

Stewardship

A catch-all term to describe the actions taken to look after our clients’ money. It commonly involves both engagement with companies, to develop a proper understanding of business developments, issues and potential concerns; and proxy voting to support or oppose issues at company general meetings.

Stranded assets

A variety of factors can lead to the risk of assets becoming stranded, such as new regulations or taxes (e.g. carbon taxes or changes in emission trading schemes) or changes in demand (e.g. impacts on fossil fuels, resulting from the shift towards renewable energy). Stranded assets risk having their value written down, impacting the value they have in a company’s accounts.

Sub-advisor

When one investment management company hires another investment management company to manage one of their funds, the hired company is the sub-advisor. Sub-advisors are sometimes used in responsible investment if they have specialist knowledge of this field that does not exist in-house.

Sustainability Accounting Standards Board

Often referred to as “SASB”, this is a non-profit organisation that sets standards for the sustainability information companies should communicate to their investors. It has produced 77 sets of industry-specific global standards. SASB looks for sustainability issues that are financially significant to a particular industry.

Sustainability risk

An environmental, social or governance risk that could hit the value of an investment.

Sustainable Development Goals (SDGs)

A set of 17 policy goals set out by the United Nations, which aim for prosperity for all without harming people and the planet. Each goal has a number of targets. For example, Goal 2 is Zero Hunger and Target 2.3 is to double the productivity and incomes of small-scale food producers. Companies can contribute to the SDGs by making products or services that help achieve at least one of the 17 goals.

Sustainable investing

Investing in a way that recognises the need for and supports balanced social, environmental and economic development for the long term.

T

Task Force on Climate-related Financial Disclosures (TCFD)

The Task Force on Climate-Related Financial Disclosures was set up by the World Bank to help companies communicate their climate risks and opportunities and how they manage them. The TFCD sets out a framework for communicating how management considers climate risks, its strategy for responding to climate change, risk management arrangements and the types of risk covered. The TCFD says companies should, for example, explain how their business strategies would cope in different temperature scenarios. From 2022 companies listed on the UK stock market will have to follow the TCFD’s recommendations for disclosing climate risks.

EU SFDR (Sustainable Finance Disclosure Regulation)

This forces funds to communicate how they integrate sustainability risk and consider adverse impacts. For funds promoting environmental or social characteristics or that are targeting sustainability objectives, additional information will need to be communicated.

The EU Taxonomy

Often called the “Green Taxonomy”. This is the EU’s system for deciding whether an investment is sustainable. Investments must contribute to one or more environmental objectives and meet the detailed criteria required for each activity or product that contributes to this. Investments must not do significant harm to any of the objectives. They must also meet minimum standards in business practices, labour standards, human rights, and governance.

Thematic investing

Researching global trends, or “themes”, to identify investments that will either benefit from changing needs or be impacted by them. Common themes are climate change and technological innovation. Often combined with sustainable investing, which looks at these trends but with an additional focus on the environmental or social implications of themes.

Transition risk

The potential risks faced by companies as society transitions towards alignment with the Paris Agreement to limit global warming. This is the risk that a company is so invested in certain incompatible operations and assets that it is uneconomical to transition to align with the Paris Agreement.

U

UN Global Compact (UNGC)

The world’s largest sustainability initiative. The UNGC sets out a framework based on Ten Principles for business strategies, policies and practices, designed to make businesses behave responsibly and with moral integrity. Companies can volunteer to sign the Compact, and can be struck off by the UN for breaking it. The Compact is commonly used by investors to assess how serious controversies are.

UN Guiding Principles for Business and Human Rights

A framework for companies to prevent human rights abuses caused by their activities. Commonly used by investors to assess the severity of companies’ human rights failures.

Informações importantes

Para efeitos de marketing. O seu capital está em risco. Columbia Threadneedle Investments é o nome da marca global do grupo de empresas Columbia e Threadneedle. Nem todos os serviços, produtos e estratégias são oferecidos por todas as entidades do grupo. Os prémios ou classificações poderão não ser aplicáveis a todas as entidades do grupo.

No Reino Unido: Emitido pela Threadneedle Asset Management Limited, n.º de matrícula 573204 e/ou Columbia Threadneedle Management Limited, n.º de matrícula 517895, ambas registadas em Inglaterra e no País de Gales e autorizadas e regulada no Reino Unido pela Autoridade de Conduta Financeira.

No EEE: Emitido pela Threadneedle Management Luxembourg S.A., matriculada no Registo do Comércio e das Sociedades (Luxemburgo), N.º de matrícula B 110242 e/ou Columbia Threadneedle Netherlands B.V., regulada pela Autoridade Holandesa para os Mercados Financeiros (AFM), n.º de matrícula 08068841.

No Médio Oriente: Este documento é distribuído pela Columbia Threadneedle Investments (ME) Limited, que é regulada pela Autoridade dos Serviços Financeiros do Dubai (ASFD). Para os Distribuidores: Este documento destina-se a fornecer informações aos distribuidores sobre os produtos e serviços do Grupo, não devendo ser posteriormente distribuído. Para Clientes Institucionais: A informação contida neste documento não se destina a constituir aconselhamento financeiro, sendo apenas para pessoas com os conhecimentos adequados de investimento e que satisfaçam os critérios regulamentares de forma a serem classificados como Clientes Profissionais ou Contrapartes no Mercado, não devendo ser seguido por quaisquer outras Pessoas.

Na Austrália: Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414 e/ou Columbia Threadneedle EM Investments Australia Limited [“CTEM”], ARBN 651 237 044. A TIS e a CTEM estão isentas do requisito de ser titular de uma licença australiana de serviços financeiros ao abrigo da Lei das Sociedades Anónimas e dependem do Despacho de Classe [CO] 03/1102 e 03/1099, respetivamente, relativamente à comercialização e prestação de serviços financeiros a clientes profissionais australianos, conforme definição dada na Secção 761G da Lei das Sociedades Anónimas de 2001. O TIS é regulada em Singapura (Número de registo: 201101559W) pela Autoridade Monetária de Singapura ao abrigo da Lei de Valores Mobiliários e Futuros (Capítulo 289), a qual difere das leis australianas. A CTEM é autorizada e regulada pela FCA ao abrigo das leis britânicas, que diferem das leis australianas.

Em Singapura: Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, que é regulada em Singapura pela Autoridade Monetária de Singapura ao abrigo da Lei de Valores Mobiliários e Futuros (Capítulo 289). Número de registo: 201101559W. Este anúncio não foi revisto pela Autoridade Monetária de Singapura.

No Japão: Columbia Threadneedle Investments Japan Co., Ltd. Operador de Negociação de Instrumentos Financeiros, o Diretor-Geral do Kanto Local Finance Bureau (FIBO) n.º 3281, e um membro da Associação de Consultores de Investimento do Japão.

Em Hong Kong: Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司, Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, que é licenciada pela Securities and Futures Commission (“SFC”) para realizar atividades reguladas do Tipo 1 (CE: AQA779). Registada em Hong Kong ao abrigo da Lei das Sociedades (Capítulo 622), n.º 1173058 e/ou emitida pela Columbia Threadneedle AM (Asia) Limited, Unit 3004 Two Exchange Square, 8 Connaught Place, Central, Hong Kong, que é licenciada pela Securities and Futures Commission(“SFC”) para realizar atividades reguladas de Tipo 4 e Tipo 9 (CE: ABA410). Registada em Hong Kong ao abrigo da Lei das Sociedades (Capítulo 622), n.º 14954504.